The Institute advances institutional resilience and excellence in sovereign wealth strategy and financial governance.

Sovereign decision-makers access a global network of expertise shaping global standards for sovereign finance through institutional excellence and continued focus on innovation and cutting-edge research.

We shape tomorrows’ sovereign leaders and institutional strategies, today.

Leadership Team

Founder & CEO

(ex IFSWF, IMF and 3 major CBs)

Kristian Flyvholm, MBA

Global Chief Investment Officer with 30+ years of private and public sector investor roles and global policy experience.

Kristian was the inaugural CEO of the International Forum of Sovereign Wealth Funds and worked at the IMF, ECB and Danish Central Bank with focus on sovereign asset management managing $100+ billion assets.

He was the Chief Investment Officer at Jyske Invest Fund Management and headed reserve management at the Central Bank of the UAE - assisting the institution to become Reserve Manager of the Year in 2022.

Kristian is a frequent speaker, panelist and global thought leader at major global events. He holds an MBA from Aarhus University and a BSc in Finance from Copenhagen Business School. Kristian sits on major global advisory boards, including UNDRR (IAB), Tobacco Free Portfolios and the University of Cambridge Institute for Sustainable Leadership.

Chief Operation Officer

(ex NBIM, University of California OCIO)

Nic Winterstorm, MBA

Nic has 20+ years of experience from major SWFs, pension funds and endowments.

At Norges Bank Investment Management (NBIM), Nic ran the investment equity operations, lead due diligence efforts and the enterprise risk management function.

At University of California, he was in charge of the operational risk and compliance team at the University of California’s investment office (OCIO) with $200+ billion in assets. He also was the COO of a Silicon Valley fintech startup, and the CCO and head of risk at a $100+ billion California-based investment advisory managing some of the largest corporate pension plans in the US.

Nic holds a BSc. in Engineering (Lund University) and a MBA from Hawaii Pacific University. He is a Stanford University scholar and licensed stock broker.

Chief Risk Officer

(Ex Oman SWF, ADQ, PWC)

Susan Daniels, FCCA

Susan Daniel is the CRO of Sovereign Investors and the founder and CEO of Aquilae Consulting Limited LLC FZ. She specializes in governance, risk management, and compliance.

With over 36 years of experience, she has held key leadership roles, including Chief Risk Officer at ADQ and Chief Risk and Assurance Officer at the Oman Investment Authority.

Her expertise encompasses developing risk management frameworks across various sectors, including oil and gas, healthcare, and financial services. A Fellow of the Chartered Certified Accountants since 1994, Susan has also served as an advisory partner at PWC, leading significant projects in the GCC region.

Passionate about embedding risk management into organizational strategy, she empowers companies to leverage governance as a strategic advantage. Susan has presented extensively on risk management frameworks and has been instrumental in training boards and committees to enhance their oversight roles.

International Advisory Council

Dr. Patrick J. Schena, Professor, Tufts University at Fletcher School

Patrick J. Schena, PhD, is BLR Professor of Practice in the Department of Economics, Tufts University and Director of Tufts’ Finance Minor. He is also Adj Professor of International Business at The Fletcher School, where for 20 years he has taught courses on finance, investment management, and private equity. Since 2009, he has served as Co-Head of SovereigNet, The Fletcher Network for Sovereign Wealth and Global Capital. In addition, he is an Associate-in-Research at the Fairbank Center for Chinese Studies at Harvard University.

In parallel to his academic work in finance, which has included teaching in several Boston-area MBA programs, Dr. Schena has 30 years of industry experience in finance, investments, operations, and technology management with a disciplinary focus in asset management.

His professional work has included finance and consultancy positions at Fortune 500 firms, as well as co-founding and serving in executive roles – including CFO, COO, and CEO - in several start-up businesses servicing the global asset management industry. He recently served as Chairman of the advisory committee of a World Bank - PIAFF study on the evolution and role of strategic investment funds.

Dr. Schena holds a PhD from the Fletcher School, Tufts University with a disciplinary concentration in international finance and capital markets, a MA in Law and Diplomacy from the Fletcher School, and MA and BA degrees from Boston College.

Dr. Niels Thygesen, Professor Emeritus at University of Copenhagen and Chair of European Fiscal Board and member of the Delors Commission

Niels Thygesen is Professor Emeritus of International Economics at the University of Copenhagen. He served from 2016-2024 as the Chair of the European Fiscal Board, which advises the European Commission and the Council on fiscal policy and governance.

Professor Thygesen worked for the Danish Government, Harvard’s Development Advisory Service (in Malaysia), and at the OECD in Paris. He served as Adviser to the Governor of the Danish Central Bank and was Chair of the Danish Economic Council. He was a member of numerous expert groups on European monetary and financial integration; the subject area of most of his research and publications.

Professor Thygesen was an independent member of the Delors Committee preparing the outline of Economic and Monetary Union in Europe in 1988-89. He was also a member of the committee advising the Government of Sweden on an exit from the crisis of the early 1990s. He was a member of the Group of Independent Experts evaluating IMF surveillance following the Asian crisis, and he chaired the Economic and Development Review Committee of the OECD, which evaluates the economic performance and policies of member states from 2000-2008. He is a Founder Member of the European Shadow Financial Regulatory Committee, the Euro50 Group and OMFIF. Professor Thygesen is an honorary member of the International Advisory Council of Sovereign Investors.

Professor Niels Thygesen studied at the Universities of Harvard and Copenhagen, where he obtained a PhD.

Dr. Paul O’Brien, Trustee, Wyoming Retirement System and former Deputy CIO at ADIA

Paul O’Brien is a Trustee, Chair of the Audit and Risk Committee, and member of the Investment Committee of the Wyoming Retirement System, the public pension fund supporting state and local employees in Wyoming. He is Chair of the Institutional Investor Middle East Institute and is active as an advisor to major global institutional investors and as a conference speaker.

From 2009 until 2019, Paul was Head of Fixed Income Strategy and Deputy Chief Investment Officer at the Abu Dhabi Investment Authority. He helped lead both strategic and tactical asset allocation, benchmark selection, portfolio construction, and research, as well as advising ADIA’s Investment Committee. He managed a multi-national team of over 20 investment professionals with expertise across all asset classes as well as economics and quantitative methods.

Before joining ADIA, Paul was a global fixed income portfolio manager at Morgan Stanley Investment Management (MSIM) in London and West Conshohocken, PA. He worked with institutional investors around the world with a focus on interest rate and currency strategies.

Prior to that, he worked as an economist for Morgan Guaranty Trust Company in Paris and in London as Head of Morgan’s European economics team. Paul started his career as Economist and then Section Chief at the Board of Governors of the Federal Reserve System in Washington, DC. He worked in the Division of Monetary Affairs and regularly briefed the Board on monetary policy issues and developments in financial markets. While at the Federal Reserve he was seconded to the Bank for International Settlements in Basel, Switzerland, and the Organization for Economic Cooperation and Development in Paris.

Paul has a PhD in Economics from the University of Minnesota. He attended the US Naval Academy and received his undergraduate degree from the Massachusetts Institute of Technology.

Dr. Paul Rose, Dean and Professor, CWRU Law

Professor Rose writes and teaches about sovereign wealth funds, corporate governance, investment management law, and securities regulation. He has consulted with and provided testimony on these topics to numerous regulators and other agencies, including the U.S. Senate Committee on Banking, Housing and Urban Affairs; the U.S. Securities and Exchange Commission; the Government Accountability Office; and the Congressional Research Service.

He has been a Senior Legal Consultant to the World Bank, an affiliate the Sovereign Wealth Fund Initiative at the Fletcher School at Tufts University, a non-resident fellow of the ESADEgeo-Center for Global Economy and Geopolitics, an affiliate with IE Business School, and an affiliate with the Sovereign Investment Lab, a research project at Università Bocconi.

He is an elected member of the American Law Institute and serves as co-chair of the Shareholder Activism and Engagement Subcommittee of the American Bar Association’s Corporate Governance Committee.

Prior to joining Case Western, Rose held the J. Gilbert Reese Chair in Contract Law and served as associate dean at The Ohio State University Moritz College of Law.

He began his academic career as a visiting assistant professor in securities and finance at Northwestern University School of Law. Before joining Northwestern, Rose practiced law in the corporate and securities practice group of Covington & Burling LLP’s San Francisco office.

He worked as an assistant trader in equity and emerging market derivatives at Citibank, N.A. in New York prior to attending law school.

Catherine Savage, Board Professional and Former Chair of New Zealand Superannuation Fund and currently MD of the Savage Group

Catherine Savage was on the Board of the New Zealand Superannuation Fund 2009 - 2021, appointed Deputy Chair in September 2012 and Chair January 2016. She was previously Chairperson of the National Provident Fund and also served as an independent director of the Todd Family Office, KiwiBank and Pathfinder Asset Management, and earlier led AMP Capital in New Zealand.

She is currently the Managing Director of the Savage Group, and sits on several boards, including NZ Rugby Union and NZ Rugby Commercial, Beca Group Limited, Kiwi Group Holdings, Invest NZ and the Pacific Pension Institute. She is Co-Chair of the New Zealand Chapter for Women Corporate Directors.

Catherine has been involved in investment management and private equity for over 35 years. Her executive and governance roles have been based largely in Asia Pacific with global mandates. In 2020 she was recognized by Asian Investor magazine as one of the Top 20 Investors in the region.

Catherine is a Fellow of Chartered Accountants Australia & New Zealand, a Fellow of the Institute of Directors and a Fellow of the Institute of Financial Professionals New Zealand.

Frank Scheidig, Global Head of Senior Executive Banking

Frank Scheidig is Global Head of Senior Executive Banking at DZ BANK, leading DZ BANK’s high level global strategic engagement with government and official institutions.

His network covers – amongst others - the German government, Bundesbank and KfW; the EU commission, EIB and ESM as well as SAFE, AIIB and the World Bank. Having previously had a 36+ years career in the capital markets, with Deutsche Bank and Dresdner Bank among others, covering governments, central banks, supranationals, state funds, and development banks. He is Deputy Chairman of the Advisory Board of OMFIF (The Official Monetary and Financial Institutions Forum), a well-connected think-tank for central banking, economic policy and public investment.

He chairs the Rhein-Main regional committee of the British Chamber of Commerce in Germany, is a member of the Board of the IBF International Bankers Forum and of the Sustainable Finance Advisory Committee of the Federal Government of Germany.

Dr. Guan Seng Khoo, Ex-Temasek & AIMCo

Dr. Guan Seng Khoo has over 30 years’ of experience in the design and implementation of enterprise wide investment, banking and risk management models, systems and processes incl. ESG/responsible Investing.

His career spans across financial institutions in the USA, Canada, UK and Singapore, including the UK-listed Man Group, American Bourses Corporation, RHB Capital, Singapore Exchange, Standard Chartered Bank, Temasek Holdings, Alberta Investment Management Corporation (AIMCo) and other major companies. Recently, he helped to establish the responsible investing unit at AIMCo where he was also the head of ERM. He sits on a number of advisory boards and is part of the SWF Academy.

He holds a PhD in Computational Physics (Material Science) from the National University of Singapore, with post-doc R&D in AI-based data mining and applications in Japan and America. He was also a co-founder of the NTU Centre for Financial Engineering and the MSc in Financial Engineering programme in collaboration with Carnegie Mellon University, Pittsburgh in 1999, when he was an academic at NTU from 1993 to 2000.

Eugene O’Callaghan, Ex-CEO of Irish SWF (ISIF)

Eugene O’Callaghan served as the Director (CEO) of Ireland’s sovereign wealth fund, the Ireland Strategic Investment Fund (ISIF) and its predecessor the National Pensions Reserve Fund (NPRF), from 2010 to 2021. ISIF has a “double bottom line” mandate to invest on a commercial basis to support economic activity and employment in Ireland. NPRF invested via investment managers globally across all asset classes with a mandate to achieve optimal long-term return subject to acceptable levels of risk. The NPRF became the ISIF in 2014. He was previously Head of Investment Manager Programme with the NPRF. He has also been a member of the Advisory Committee for the International Forum of Sovereign Wealth Funds (IFSWF) (2017-2021).

Eugene joined NPRF in 2005 from Irish Life Investment Managers, Ireland’s largest investment management firm, where he had been chief operating officer in addition to numerous other roles in a 15-year tenure. Prior to that he lived in New Zealand for five years where he worked in an investment bank and in a major accounting firm.

Today, Eugene is an advisor to investment funds and businesses. He is Co-Founder of EHA Advisory, a boutique advisory firm that supports the re-design, reshaping and implementation of sovereign and long-term investment funds based on global best practice standards, and he is a member of the Faculty Board of the SWF Academy.

He is a chartered accountant and holds a Bachelor of Commerce degree from University College Dublin.

Dr. Massimiliano Castelli, Managing Director, Head of Strategy, Sovereign Institutions, UBS Asset Management

Max has over two decades of experience advising some of the world’s most influential institutional investors. Max is recognized expert in sovereign wealth management and central bank advisory. His work focuses on asset allocation, global macroeconomic strategy, and the evolving role of state-owned investors in the international financial system.

He has built trusted relationships with leading sovereign institutions across Europe, the Gulf, China, and broader Asia, providing strategic insights that help navigate complex markets and long-term investment challenges. Drawing on a strong academic foundation in economics, he offer clients a data-driven and forward-looking perspective on global economic trends, capital financial markets, and geopolitical developments.

He is frequently quoted in major international media and contribute regularly to leading publications and platforms. His research and perspectives are widely followed in the asset management and policy communities, positioning him as a thought leader at the intersection of finance, economics, and public policy. He is the co-author of the acclaimed book The New Economics of Sovereign Wealth Funds published by Wiley Finance. He is in the process of finalizing the second edition.

In his thirty years-long international career, Max has been Head of Public Policy for UBS in Europe, Middle East and Africa, Senior Economist for Emerging Markets at UBS and consultant advising governments and corporates in emerging markets on behalf of international institutions

Max holds a PhD in Economics from the University of Rome where he lectured and a Msc in Economics from the University of London. He is the co-Chairman of the Asset Management Investment Council (AMIC) at the International Capital Market Association.

Robert “Bob” Barnden, Former Partner at PWC

Robert “Bob” Barnden is a Swedish finance professional born in England in 1946. His professional qualification includes being a Fellow Chartered Accountant (FCA). He pursued his higher education at the University of Exeter in the UK, where he studied Politics, Philosophy, and Economics from 1965 to 1968. Next, Mr. Barnden embarked on a successful career in finance, joining PwC, where some of his notable achievements reaching to Partner level included:

·CEO of PwC in Saudi Arabia: Mr. Barnden served as the CEO of PwC's Saudi Arabian operations, overseeing approximately 400 staff members. During his tenure, he was responsible for managing the firm's operations in the country.

·Partner of PwC in Sweden: Robert was responsible for the audit of several large listed companies. He also worked closely with some of Sweden’s major private equity firms on mergers & acquisitions. In addition, he held the position of Global Forest, Paper & Packaging Leader at PwC. In this role, he contributed to industry reports and provided insights on the forest, paper, and packaging sector.

Throughout his career, Robert Barnden has been involved in numerous industry initiatives. For instance, he contributed to PwC's "CEO Perspectives" report in 2008, which provided insights into the forest, paper, and packaging industry worldwide.

Winston Ma, CFA & Esq. Executive Director of GPIFF and Adjunct Professor, NYU School of Law

Winston Ma, CFA & Esq., is an investor, attorney, author, and adjunct professor in the global AI-digital economy. He is a partner of Dragon Global, an AI-focused family office (founding member: Dragon.AI). He is also the Executive Director of the Global Public Investment Funds Forum (GPIFF) and an Adjunct Professor at NYU School of Law.

Most recently for 10 years, he was Managing Director and Head of North America Office for China Investment Corporation (CIC), China’s sovereign wealth fund. Prior to that, Mr. Ma served as the deputy head of equity capital markets at Barclays Capital, a vice president at J.P. Morgan investment banking, and a corporate lawyer at Davis Polk & Wardwell LLP.

A nationally certified Software Programmer as early as 1994, Mr. Ma is the author of more than 10 books on SWF funds, digital economy, and global geopolitics, including The Hunt for Unicorns: How Sovereign Funds are Reshaping Investment in the Digital Economy. He has been a member of NYU President's Global Council since its inception. He was selected a 2013 Young Global Leader at the World Economic Forum (WEF), and in 2014 he received the NYU Distinguished Alumni Award.

Seema A. Khan, (Hon) Senior Advisor, OIC-COMSTECH. Ex-KSA Ministries of Investment & Sports. Serial Entrepreneur

Seema has led at the forefront of global change across industry and government, consistently breaking new ground as the “first” woman in high-stakes roles while defining her legacy as enabling success for others. She leads The Seed Advisory Group, a private office, and is the Vice-Chair of Johara Global, a social enterprise that redefines women’s leadership development from a multicultural perspective. The Organization of Islamic Cooperation-Committee for Science and Technology has appointed her as its Honorary Senior Advisor, to spearhead its strategy coordination across its 57 member states.

Her career began at Tradescape.com as its general counsel and a co-founder. ETrade acquired it for +$250MM in 2002. The only woman of color on Wall Street’s C-Suite at the time, her advocacy helped regulators recognize day-trading technology as a tool that created greater market transparency and accessibility for all investors. Tradescape democratized trading to open wealth creation opportunities once reserved for the few.

Adept at guiding large scale portfolios under close international scrutiny, Seema served as the Chief Strategy Officer of the Saudi Arabian General Investment Authority (SAGIA) from 2002-2012. SAGIA’s policy impact earned its elevation to ministry status as the Ministry of Investment.

After a brief tenure in private family office service, Seema returned to public service. She served as the Senior Advisor to the Saudi General Sports Authority (GSA) from 2016-2020, guiding the sport’s economy’s development. The GSA’s impact on the Saudi economy has resulted in its elevation to ministry status as the Ministry of Sport.

A NY Bar admitted lawyer who studied at the School of International Service, the American University WDC, the IIT-Chicago Kent College of Law, and Columbia Law School, Seema is deeply committed to education and environmental philanthropy. She is a board member of the Out of Eden Walk, a National Geographic-supported journalism NFP, and the Proteus Ocean Group, the International Space Station of the Seas. In Saudi, she served on the Alfaisal University College of Business Advisory Board and as the Vice-Chair of the ILMI Science Discovery and Innovation Center. The Salzburg Global Seminar recognized Seema for opening the doors of leadership to others, while the US Congress has awarded her its Bronze Congressional Medal for Service.

Sven Otto Littorin, Former Swedish Minister for Employment and Chairman

Mr. Sven Otto Littorin is an entrepreneur and board professional with 30+ years of experience in international business and policy making. He is currently Chair of White Pearl Technology Group, an international IT transformation agency with offices in 28 countries around the world, listed on Nasdaq First North in Stockholm. In addition he is Chair of Raytelligence AB, listed on Nordic Growth Market, and Vice Chair of AB Igrene, listed on Spotlight Stock Market.

In 2006-10 he was Sweden’s Cabinet Minister for Employment. Among his previous positions he was Secretary General of the Moderate Party 2002-06 and the Chief of Staff to the Swedish Minister of Fiscal and Financial Affairs. In 2009, during the Swedish Presidency of the European Union, he was President of the EU Council of Ministers in its EPSCO formation.

Mr. Littorin was an advisor to the Ministry of Labor and Social Development in Riyadh in 2017-21, focusing on developing and delivering the New Labor Market Strategy, following Vision 2030. He is still very active in the region. Mr. Littorin holds a B.Sc. in Economics and Business Administration from Lund University, Sweden.

Scott Kalb, MA, Harvard, Ex-CIO of KIC

Scott Kalb is the former CIO and Deputy CEO of the KIC, Korea’s $200 bn sovereign wealth fund. Scott presided over 300% growth in AUM during his four-year tenure at the KIC (2009-2012). Currently, Scott serves as Founder and Director of the Responsible Asset Allocator Initiative at the Fletcher School, where he is rating the world's 300 largest asset owners on their responsible investment practices, and producing research to help them think through the next stages of their responsible investing programs.

As CEO of KLTI Advisors since 2013, Scott has worked with sovereign wealth and pension funds around the world, and currently consults for the World Bank/IFC on pension and capital markets projects in developing countries, including Georgia, Rwanda, and Vietnam. In addition, Scott is Co-founder and Chairman of Bright Feeds, a company that converts food waste into animal feed, saving millions of dollars for businesses while removing harmful carbon emissions. Scott also is Chairman of the Sovereign Investor Institute, the world’s leading community for sovereign wealth and public pension funds.

Locally, Scott served two terms in the town of Greenwich legislature, and in 2023 was elected to the Greenwich Board of Estimate and Taxation, setting the tax rate and developing the town’s $500 million budget. He serves on the Boards of the Greenwich Retirement System and OPEB Trusts, as well as on the Connecticut Coalition for Sustainable Materials Management (CCSMM) organized by the CT Department of Energy and Environmental Protection (DEEP). Scott earned an MA degree from Harvard University and a BA with Honors from Oberlin College.

Philipp A. Schoeller, MBA, Entrepreneur, Investor & Philanthropist. Founding Partner of GenCap

Philipp A. Schoeller is a highly accomplished German entrepreneur, investor, and philanthropist with a career spanning over three decades. He holds degrees in Electrical Engineering from ETH Zurich and an MBA from INSEAD, where he graduated with honors. Schoeller began his professional journey at Boston Consulting Group, specializing in financial services and post-merger integrations.

He is the Founding Partner of General Capital Group (GenCap), an investment firm based in Munich with €25 billion in committed capital. Under his leadership, GenCap has focused on public and private equity investments, including stakes in major German companies like Volkswagen, Siemens, and BASF. Before GenCap, Philipp Schoeller founded GCI Management and GSM Industries, both of which achieved notable success in venture capital and middle-market turnarounds.

Philipp is deeply committed to philanthropy and public service, serving as Honorary Consul of Finland for Bavaria and Thuringia. He is also co-founder of the Fragile World Foundation, where he co-authored the book “Fragile Welt”. He is a Senator of the European Senate of Entrepreneurs and a former member of the Club of Rome. He is the former Chairman of the Rhine Chapter of the Young Presidents Organisation. Founding Partner EarthGuard, a Space Parasol Project reducing Solar Energy on Earth by up to 1.5 degree celcius. He is also a full member of the European Academy of Sciences and Arts.

Arif Shaikh, Banker, Board Member & Senior Risk Advisor

Mr. Arif Shaikh is a Senior Risk & Compliance Advisor in the UAE with stints with different institutions in the area of Risk Management, Compliance, Corporate Governance etc. He has been the advisor to HE the Governor of the Central Bank of the UAE for Risk, Compliance and other banking services and is a Board Member on a CBUAE Subsidiary. Prior to this role, he has been the Senior Executive Vice President / Group Chief Risk Officer at First Abu Dhabi Bank (FAB); he has been associated with the Group since Jan 2001 with responsibilities including Enterprise Risk Management function, Information Security, Group Compliance Function, Group Legal function and the overall Corporate Governance of the bank. He has set up these functions at FAB from scratch and has developed the current risk framework at FAB on a global basis.

He has had stints on the Board of CBUAE/FAB subsidiaries and external companies in the Real Estate, Islamic Finance, Dubai First, FGLB, etc. He is currently on the board of Oumulat Security Printing and the Abu Dhabi Awqaf Authority.

Prior to joining FAB, Mr. Shaikh has worked with HSBC, ANZ Grindlays Bank, Standard Chartered Bank, KPMG & PWC covering a variety of positions including Risk Management, Audit, Finance, Trade Finance, Corporate Banking, Branch Management, Banking Consultancy, etc. Mr. Shaikh has had working stints in different parts of the world apart from his current base in Abu Dhabi.

Mr. Shaikh holds a Bachelors Degree in Commerce, Bachelors Degree in Law and is also a qualified Chartered Accountant with the Indian Institute of Chartered Accountants.

Dr. Celeste Cecilia Moles Lo Turco, Ex PwC, NEOM

Dr. Celeste Lo Turco is a Sovereign Wealth Funds (SWFs) and Sustainability Expert. She is the Chief of Staff at Saudi Investment Bank and worked as Director for PwC in the ESG & Sustainability field.

Dr Celeste Lo Turco started her career working for the SWFs Strategic Committee of the Italian Ministry of Foreign Affairs and the SWFs Law Centre. She became then the advisor for the Italian Municipalities National Association on the development of the national economy through the relationship with SWFs. Former United Nations analyst with a specialization in Security and Middle-East Political Affairs, she worked within the United Nations Interregional Crime and Justice Research Institute (UNICRI).

The Middle East has been her house for more than ten years. She started in the United Arab Emirates working as Vice President Strategy for Future Holding, a Middle Eastern family office based in Dubai, moving then to the Kingdom of Saudi Arabia where she worked as a Director at NEOM. As a Director at PwC in Dubai, she worked with emphasis on ESG and Sustainability practices.

A Georgetown University Fulbright Visiting Researcher, she holds a PhD in Political Theory and a Master’s degree in International Relations, Markets and Institutions of the Global System.

Dr. Demir Bektić, PhD. Head of Asset Solutions and member of Investment Committee at Commerzbank. Adjunct Professor of Finance at the International University of Monaco and at the Institute of Management Technology in Dubai

Dr. Demir Bektić is Head of Multi Asset Solutions and a member of the Investment Committee at Commerzbank AG. After completing his studies in Business Informatics at the University of Mannheim, he earned his PhD in factor-based investment strategies at TU Darmstadt, where he was also a visiting scholar at the University of Chicago Booth School of Business. Following his initial positions in portfolio management & trading at Lupus alpha and as a portfolio manager at a single family office, he became Executive Director and Head of Quant Fixed Income at Deka Investment. Additionally, he served as Managing Director at IQ-KAP, the Institute for Quantitative Capital Market Research of DekaBank. Subsequently, he managed a hedge fund at ansa capital management and later became Head of Portfolio Management at the multi-family office FINVIA, where he was a member of the Investment Committee.

He is an Adjunct Professor of Finance at the International University of Monaco and at the Institute of Management Technology Dubai. He has also been a visiting professor at the University of Miami and a lecturer at TU Darmstadt. He regularly presents his research at international conferences and received the Bernstein Fabozzi / Jacobs Levy Outstanding Article Award from the Journal of Portfolio Management for a publication on Factor Investing. Furthermore, he serves as an independent expert on the jury of the German Alternative Investment Association (BAI) for awarding the annual BAI Science Award and is a reviewer for numerous academic finance journals.

Dr. Jürgen Braunstein, Assistant Professor, Vienna University of Economics. Lecturer at Harvard University DCE Sustainability Program & Affiliate, Harvard Center for European Studies

Dr. Jürgen Braunstein is currently Assistant Professor (tenure track) at the Vienna University of Economics and Business where he leads the Geofinance Unit. He is also affiliated with the Harvard Center for European Studies and lectures at the Harvard DCE Sustainability Program. Prior to this he was a fellow and post-doctoral researcher Harvard's Geopolitics of Energy Project.

He has been actively involved in the G20 Think20 task force during the presidencies of Indonesia (2022), Italy (2021), and Saudi Arabia (2020), focusing on financing in a decarbonizing context. Previously, he coordinated the urban finance workstream for the New Climate Economy (NCE) at the London School of Economics (LSE) Cities research center. He is the author of Capital Choices: Sectoral Politics and the Variation of Sovereign Wealth (2019), published by Michigan University Press. In 2022, a revised edition of his book received the ASCINA Principal Investigator Award. In 2023 his research project on 'Energy Finance Transitions' (ENFIN) was awarded with an ERC Starting Grant from the European Commission.

Ana Nachkebia, CFA, Acting CIO at the Pension Fund of Georgia

Ana Nachkebia is the Acting Chief Investment Officer at the Pension Fund of Georgia, the country’s only public pension fund, established in 2018. The Fund plays a vital role in developing Georgia’s capital markets and securing retirement savings for the Georgian population.

Since joining the Fund in 2023, Ana has progressed from Portfolio Manager to Deputy CIO, leading key initiatives in strategic and tactical asset allocation, investment governance, and stakeholder transparency. In her current role as Acting CIO, she oversees the Fund’s investment strategy and represents the institution on international platforms.

Ana brings experience across both public and private sectors, including roles in impact investing at Finance in Motion—a leading global impact investor—capital markets research at Galt & Taggart, Georgia’s leading investment bank, and the launch of the country’s first retail investment platform. She began her career in banking supervision at the National Bank of Georgia.

Ana holds an MSc in Finance from EDHEC Business School and a BBA in Finance from Caucasus University. A CFA Charterholder since 2022, she also lectures on finance and investments at several Georgian universities, including Caucasus University and ISET.

James Hewitt, MBA, Former Sr. Regional Director, Deloitte and Board Advisor to Eurex

James Hewitt is a GCC-based investment specialist with over 30 years of experience working with Sovereign Wealth Funds (SWFs), endowments, and institutional investors. He began his career in 1991 as a derivatives broker, later advising major European SWFs on front-to-back office structures and hedging strategies. From 2019-25, he was the Sr. Regional Director working on SWFs with Deloitte in the Middle East.

As a Board Advisor to Eurex, James played a key role in fostering market development and building connections between Europe and the GCC. For the past two decades, he has worked closely with GCC SWFs, leading projects focused on SWF creation, operational transformation, and aligning portfolio companies’ investment practices with institutional governance and risk frameworks.

James holds an MBA from Bayes Business School, has held global investment and broking licenses, and is a graduate of the Royal Military Academy Sandhurst.

Reza Mahmud, Ex Brunei Investment Agency, Aviva Life & Pension and PwC

Reza is a seasoned investment professional within portfolio management and advisory for asset owners, asset managers, and regulators across APAC, the UK, EMEA, and CEE.

With PwC in Singapore, Reza supported clients on asset management and ESG topics. Previously, he was Head of Research at PwC UK’s investment advisory practice, where he established an investment committee for their sovereign wealth, pension, insurance, private wealth, and family office businesses.

Before PwC, Reza managed multi-asset portfolios at Aviva Life & Pensions, overseeing £100B+ as a member of its investment committee. He also worked in equity research at Legg Mason in Baltimore and began his career at Brunei’s sovereign fund.

His background spans listed and private equity, debt, real and digital assets, hedge funds, and derivatives. He has been a keynote and roundtable speaker in the UK, USA, and Asia on investments and AI. He has also delivered training on investments, ESG, and geopolitical risk to staff, clients, and regulators worldwide.

Reza holds an Investment MSc from Cass Business School and an LLB from Exeter University. He studied behavioral finance, cognitive science and psychology at Harvard University, Chicago University, Johns Hopkins University, and London Business School, in addition to completing a GenAI program by Stanford University and OpenAI.

Karina Luchinkina, MBA, Ex-PwC, Board Advisor

Karina Luchinkina brings 25+ years of global experience in governance, energy, and finance, with a proven track record in performance improvement, strategy, and risk management. She has held senior leadership roles with PwC and has served as a trusted advisor to governments and SWFs. At PwC, Karina led Governance, Risk, and Control services for SWFs, delivering innovative solutions to enhance governance frameworks, responsible investment strategies, and operational resilience. As a Senior Director in Global Deals Origination, she sought off-market transactions for the world’s largest institutional investors, including sovereign funds and private equity firms, leveraging her extensive network and expertise in deal structuring. Her work also focused on responsible investment solutions, helping clients integrate ESG principles into investment strategies and governance practices.

Karina’s executive experience includes serving as Chief Operating Officer and Global Head of Strategic Partnerships at Arabesque Holding, a pioneer in ESG and AI-driven investment technologies. Her leadership was instrumental in corporate transformation, strategic alliances, and financing for high-growth initiatives.

As an Independent Non-Executive Director of Main Gas Pipelines of Ukraine (MGU), Karina guided the company through transformational European certification, asset and corporate unbundling and governance reforms and spearheaded sustainability efforts within one of Europe’s most critical infrastructure entities.

Karina holds an MBA from London Business School and degrees in marketing and engineering. She is passionate about strategic leadership, fostering collaboration, and advancing sustainable solutions on a global scale.

Olivier Rousseau, Ex-Chairman of the Investment Board of the Pension Fund of Georgia, Tbilisi , Ex-co-CEO at The French Pension Reserve Fund

Olivier Rousseau started his career at the French Treasury in 1986. He then spent 11 years with BNP Paribas in financial markets and corporate and investment banking in Tokyo, Paris, London, Singapore, Hong-Kong and Sydney. He also served on the resident board of the European Bank for Reconstruction and Development in London (2004-2006) and at the French embassy in Stockholm as regional economic counselor (2006-2011).

At the end of 2011, he was appointed co-CEO of FRR, The French Pension Reserve Fund and chaired the Asset manager selection committee until the end of his second six-year term in 2024. He also chaired the Investment Board of the Pension Agency of Georgia (Tbilisi) from its establishment in June 2019 until its replacement by the Governing Board of the Pension Fund of Georgia in May 2025.

Olivier Rousseau is a graduate from ENA, France's National School of Administration, and holds a BA degree in political studies, a master's degree in law and a master's degree in economics from the university of Aix-Marseille. He won the Investment and Pensions Europe IPE golden award 2024 for Outstanding Industry Contribution and the Markets Group 2025 European CEO Lifetime Achievement Award.

Dr. Yougesh Khatri, PhD. Ex-IMF. Associate Professor at Nanyang Business School and Academic Director for the Nanyang Fellows MBA Programme

Yougesh Khatri is an Associate Professor at Nanyang Business School and is the Academic Director for the Nanyang Fellows MBA Programme. He is also an Associate Fellow at the Global Economy and Finance Department of Chatham House (UK); a member of the OMFIF Advisory Council (UK); Member of the Academic Council of the Global FinTec Institute (Singapore); and a member of the Stewardship Discussion Circle of the Stewardship Asia Centre (Singapore), among other things.

Prof. Khatri returned to full-time academia after more than two decades spanning careers at the IMF and in financial markets.

Between 1998 and 2009, he was an economist with the International Monetary Fund (IMF). He spent two years at the IMF Regional Office for Asia and the Pacific in Tokyo (working on Japan and regional issues), and three years as an IMF Resident Representative in Jakarta.

During 2010-11, he led macroeconomic research on Southeast Asia at Nomura Singapore Ltd (while on leave from the IMF).

During 2011-2015 he held senior roles as GIC including Head of the Economics and Capital Markets, Head of New Horizons and Advisor at the GIC London office.

From 2015 to early 2018, he was the Managing Director of Alphanomiks PTE Ltd, based in London and travelling regularly to Asia for macroeconomic, financial sector and public policy advisory work - including as an Advisor to GIC, a Senior International Advisor to the Australia-Indonesia Partnership for Economic Development (PROSPERA) in Jakarta and as a consultant to the Asian Development Bank on various projects in Asia.

Herald Bonnici, Former CEO of Malta Government Investments & Founder of the EMENA Sovereign Wealth Funds Collaborative Network

Herald Bonnici is a seasoned figure in the realms of financial engineering and corporate governance with a strong career that spans both the public and private sector.

As CEO of Malta Government Investments, he successfully oversaw a portfolio of companies worth €400 million. He played a crucial role in the establishment of EMENA in 2022; a SWF network that connects diverse nations across Europe, the Middle East, and North Africa. Founded by Malta Government Investments, the Sovereign Fund of Egypt, BpiFrance, and COFIDES, EMANA promotes collaboration and facilitate the sharing of invaluable knowledge among its members.

Previously, Herald served as Director General within Malta's Ministry of Finance, where he represented the country on key platforms such as the EU Council’s Financial Services Committee and the European Commission’s Tax Policy Group.

Currently he serves as the Secretary General of the Private Equity and Venture Capital Association Malta, an organisation established in 2024 to promote these investment sectors. His extensive expertise includes several non-executive directorships with subsidiaries of prominent global corporations, including a technology firm listed on the S&P 500 and a Swiss energy solutions group focused on Africa. Additionally, he is actively involved in fintech, particularly in payment services.

Herald’s knowledge extends into the domains of sustainable finance, real estate development, and affordable housing initiatives. He co-chairs the Real Estate and Urban Development Chapter of the World Association for Public-Private Partnerships, while also having led the Maltese Turkish Business Council and had been nominated by His Excellency, The President of Malta to sit on the board of the Malta Community Chest Fund Foundation, a charity organisation that aids individuals in need, offering financial, medical, and social support.

As an highly regarded speaker and moderator, he frequently participates in international events such as Middle East Energy, Africa Energy Forum, SuperReturn International and Cityscape Global. His impactful contributions to financial policy, sustainability, and global development have earned him widespread recognition and respect within the industry.

He holds an MBA from The University of Warwick (UK) and a first degree in education.

Dag Detter, Principal at Detter & Co - Global Expert on Public Wealth Funds

Dag Detter is a financial advisor to governments and other sovereign entities worldwide on boosting non-tax revenues from public commercial assets, such as corporates, utilities and real estate. He has worked in over thirty countries on a permanent and project basis and served as a Non-Executive Director of both listed and private companies.

Dag led the comprehensive restructuring of Sweden’s USD 70 billion national portfolio of commercial assets, the first attempt by a European government to systematically address the ownership and management of government enterprises and real estate. This led to a value increase of the portfolio twice that of the local stock market and helped boost economic growth, debt sustainability and fiscal space.

He is the author of ‘Public Net Worth – Accounting, Government and Democracy’, ‘The Public Wealth of Nations’ – The Economist and Financial Times’s best book of the year, ‘The Public Wealth of Cities’ and ‘The Art of Losing SEK4 trn – a Swedish case study’. He writes regularly in international media.

Dag has a background as an investment banker in Asia and Europe, followed by hands-on restructuring roles with major European non-executive boards and advisory positions spanning private equity and international consultancy firms, to international financial institutions such as IMF, World Bank and the Asian Development Bank.

Gilbert Nyatanyi, Lawyer and former CEO of Agaciro Development Fund (SWF in Rwanda)

Gilbert Nyatanyi is a banking and finance lawyer.

He has more than 25 years’ experience of providing general legal advice, and more than 20 years’ specific experience of advising on banking and finance law, with both domestic and international transactions, including multiple jurisdictions and cross-border transactions in Africa in both civil and common law.

He has advised companies, banks, international lenders, financial institutions and governments both in Europe and in Africa (especially Burundi, Central African Republic, Democratic Republic of Congo, Rwanda, United Republic of Tanzania).

From September 2020 to September 2023, Gilbert Nyatanyi was Chief Executive Officer of Agaciro Development Fund, Rwanda Sovereign Wealth Fund.

He is also a member of the Advisory Board of Sovereign Impact Initiative and Oryx Impact and is a consultant for Janson, one of the oldest, largest, and most prominent independent business law firms in Belgium.

Niclas Hiller, former Head of External Manager Group at NBIM and CIO at Formue, Norway

Niclas Hiller former Chief Investment Officer at Formue AS brings over 30 years of global investment experience across institutional and private wealth management. Known for his strategic insight and commitment to quality, Niclas has played a pivotal role in shaping and scaling investment platforms that deliver long-term value to clients.

Before joining Formue, Niclas was part of the founding team at Norges Bank Investment Management (NBIM) — Norway’s Sovereign Wealth Fund — where he was hired at its inception to help develop and manage the fund’s mandate during its crucial first decade. During this period, he was deeply involved in building the organization’s external asset management platform and fixed income operations. His tenure offered the rare opportunity to collaborate with and learn from some of the world’s leading institutional investors, asset managers, and academics. These interactions were instrumental in shaping NBIM into one of the most respected sovereign wealth funds globally.

At Formue, Niclas has applied the same level of institutional rigor and forward-thinking vision. Since joining the firm in 2010, he has overseen the growth of assets under management from NOK 30 billion to over NOK 160 billion across Norway, Sweden and Denmark. He has built and led a team of 30 investment professionals and implemented a centralized discretionary asset management model, elevating both performance and efficiency. Under his leadership, Formue was named Norway’s top private bank in the 2024 Kantar/Prospera survey, recognized specifically for its investment competence and track record.

Niclas holds an advanced degree in Portfolio Theory and a CEFA certification from the Stockholm School of Economics, with additional graduate-level studies at the University of Zurich and Uppsala University. He is also board certified and manage all Scandinavian languages, English and German.

Niclas is widely respected for his ability to combine deep technical expertise with a global, long-term perspective — delivering investment solutions rooted in quality, discipline, and excellence.

Dr. Ehab Elsonbary, Partner, DLA Piper & Ex-Sr. Legal Council at Qatar Investment Authority

Dr. Ehab Elsonbaty’s practice focuses on sovereign wealth funds, government advice & projects and affairs, corporate matters, corporate governance, sustainability, ESG and Sharia Islamic-compliant legal services. He advises Middle Eastern entities seeking to do business in the Americas and Americas clients seeking to do business in the Middle East.

Ehab is a strategic advisor to many boards or directors and advisory boards. He helps the firm deliver seamless cross-border solutions for Middle East entities, among them corporate enterprises, private equity investors, family offices, government entities and sovereign wealth funds. He helps clients maximize inbound and outbound opportunities arising from this dynamic region, providing comprehensive bilingual legal services and sensitive on-the-ground awareness of each geography in this diverse region.

Before joining DLA Piper, Ehab served as senior legal counsel and head of corporate governance and government affairs and senior advisor to the general counsel on special projects at the Qatar Investment Authority (QIA), Qatar's sovereign wealth fund and one of the largest sovereign wealth funds in the world. There, he was responsible for strategic, corporate, sustainability, ESG and special projects and transactions valued at billions of dollars as well as being a member of several management committees including the Management Investment Committee and the Crisis Management Committee.

Earlier in his career, he served for six years as senior legal advisor to the Amiri Diwan, the office of the Amir of Qatar at the Royal Court. During this time, Ehab was also a member of many policy and legal committees, among them the Permanent Legislative Committee of the Council of Ministers and the Committee for Review of Legislation, as well as a member of the National Committee to Review Commercial Laws of the Ministry of Economy and Trade. Ehab drafted and contributed to several laws and regulations of Qatar, GCC and Middle East. In addition, he served as a public prosecutor in the Egyptian public prosecution, and as a judge in the commercial courts and with Assistant Minister of Justice for more than 15 years, most recently as a judge in Cairo's Court of Appeal. He is currently admitted to the Bar in Egypt and is a certified and practicing arbitrator and mediator, and a member of the Egyptian Judges Club.

During his service in Egypt, Ehab was seconded to the Ministry of Justice's Office for International Cooperation and Human Rights, was an advisor to the Minister of Telecommunication and Information Technology, a member of the National Committee for Humanitarian Law, a member of the National Committee for Counter-Terrorism and the national committee to control the public elections. He has provided consultancy support to several regional and international organizations, such as UN, UNODC, ITU, UNCTAD, the Council of Europe and the Arab League.

Vitaly Veksler, CFA, CEO of Beyond Borders Investment Strategies

Vitaly Veksler, CFA, is a macro investment professional with 25 years of experience. He is the founder of Beyond Borders Investment Strategies, LLC (BBIS). The firm manages equity portfolios built from single-country exchange-traded funds of nations where stock markets trade at significant discounts to their historical average valuations, usually during major crises. At BBIS, Vitaly aims to earn returns for the firm’s clients and help end country crises by protecting existing jobs and creating new ones within publicly traded companies.

Before BBIS, Vitaly was Vice President at BNY Mellon Asset Management. He authored popular quarterly Global Economic & Market Outlook reports for BNY Mellon’s largest institutional clients, such as central banks, sovereign wealth funds (SWFs), public and corporate pension plans, university endowments, and foundations. In the reports, he analyzed trends affecting various investment asset classes worldwide and recommended appropriate global portfolio allocations. Previously, Vitaly wrote more than 200 investment reports for portfolio managers at Fidelity Investments and State Street Research (now BlackRock). In the reports, he analyzed trends affecting global equities in the Technology, Alternative Energy, and Energy industries.

Vitaly has spoken on global macro and impact investing topics to audiences at events and conferences organized by leading business and academic organizations such as the CFA Society Boston, Asharq/Bloomberg TV, Boston University, Tufts, Cornell, Harvard, and MIT. Articles and interviews with Vitaly have been published on ETF.com, Yahoo Finance, Fidelity.com, The Investors Podcast, Finding Unique Value Podcast, and Advisors Perspectives.

Vitaly received an MBA from the MIT Sloan School of Management, a Master of Arts in Law and Diplomacy with a focus on international finance from Tufts University’s Fletcher School, and a Diploma in Management Information Systems and Artificial Intelligence from the Moscow Technical University.

Dr. Hubert Danso, CEO and Chairman, Africa Investor

Dr. Danso is the Chief Executive Officer and Chairman of Africa investor (Ai) Group – a pan African Infrastructure Investment Holding Company for institutional investors. He also serves as the Chairman of the CFA New York Society Global Asset Owners’ Advisory Council, the Chairman of the African Sovereign Wealth & Pension Fund Leaders Forum and is the Chair of The African Union’s Continental Business Network (CBN) and the Chair of the African Green Infrastructure Investment Bank Advisory Board (AfGIIB).

Dr. Danso serves on the Accounting for Sustainability (A4S) Advisory Council and Co-Chair’s the SMI Africa Council established by King Charles III. He also serves on the World Benchmarking Alliance Just Transition Advisory Group, and is an Advisory Board Member for UNDP’s Africa Green Business and Financing Initiative and the Sustainable Development Goals (SDG) Investor Map.

Dr. Danso leads Ai’s Pension and Sovereign Wealth Infrastructure Co-Investment Platform and advises corporates, institutional investors, governments and development finance institutions on ESG trends, infrastructure allocations and private equity investments in Africa. Dr Danso was instrumental in establishing the NEPAD-AU 5% Agenda Infrastructure Investment Initiative, for Pension and Sovereign Wealth Fund infrastructure investors.

Sertan Ayçiçek, CEO, IKAR Holdings, MBA

Sertan Ayçiçek is a globally renowned business leader, visionary, and philanthropist, recognized for his leadership and strategic intelligence. With over 20 years of experience as a CEO in some of the world’s biggest holdings, he has been honored four times with the “CEO of the Year” award, underscoring his influence and impact on the global stage. As the driving force behind IKAR Holdings, he leads a diverse empire of more than 40 companies across sectors such as aviation, technology, energy, education, health, sports, and tourism. Not only is he known for building successful businesses, but also for leading innovative and transformative investments that empower communities and create lasting change.

Sertan Ayçiçek has continuously worked at the intersection of business innovation and social impact. His diplomatic acumen has enabled him to build and maintain strong relationships with global leaders, including ministers and prime ministers connections that provide him with a broad, global perspective on addressing systemic challenges.

Sertan Ayçiçek holds a Master of Business Administration (MBA) and remains dedicated to driving both economic growth and positive social change

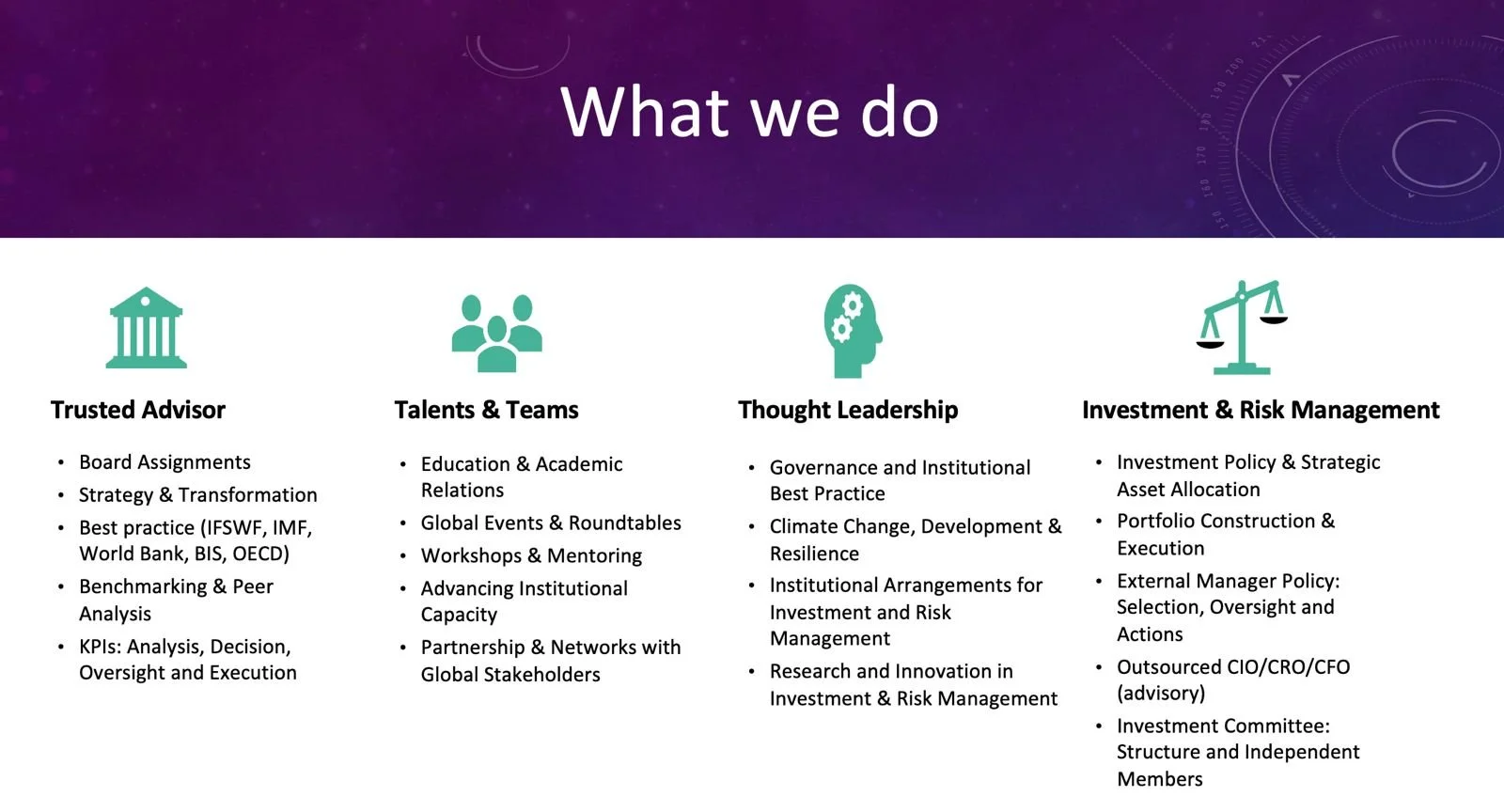

STAKEHOLDERS

STRATEGIC LEVEL:

THE BOARD OF DIRECTORS

We engage as Executive Board Advisors and offer policy guidance and gap analysis to put in place a best practice framework in line with the Santiago Principles and IMF/World Bank/OECD/BIS guidelines.

We put in place investment policy, external fund manager policy and risk management frameworks - and can guide on co-investments and sustainability and cutting edge technology (AI and machine learning).

TACTICAL LEVEL:

INVESTMENT & RISK COMMITTEE

We engage as Senior Advisors to the Investment and Risk Management Committee and guides on the strategic asset allocation to review how well risk/return objectives and constraints are institutionalized.

We assist in the design of investment guidelines, risk management frameworks and how to develop an excellent in-house and external fund manager framework.

We take on bespoke assignments to meet specific scope and objectives. This could include designing benchmark strategy and offering full guidance on the process to search for external fund managers and sophisticating in-house teams. We devise investment guidelines and assist in putting the SAA in place.

We offer outsourced CIO function and analytical capabilities to optimize the investment strategy and its execution.

OPERATIONAL LEVEL:

INVESTMENT & RISK DEPARTMENT

Connect & Network

E-mail: kf@sovereign-investors.com

Call: +(45) 5384 0445

LinkedIn: https://www.linkedin.com/in/flyvholm/

Reach out to understand how we can work together and put your capital ideas to work in a global partnership.